Industries We Serve

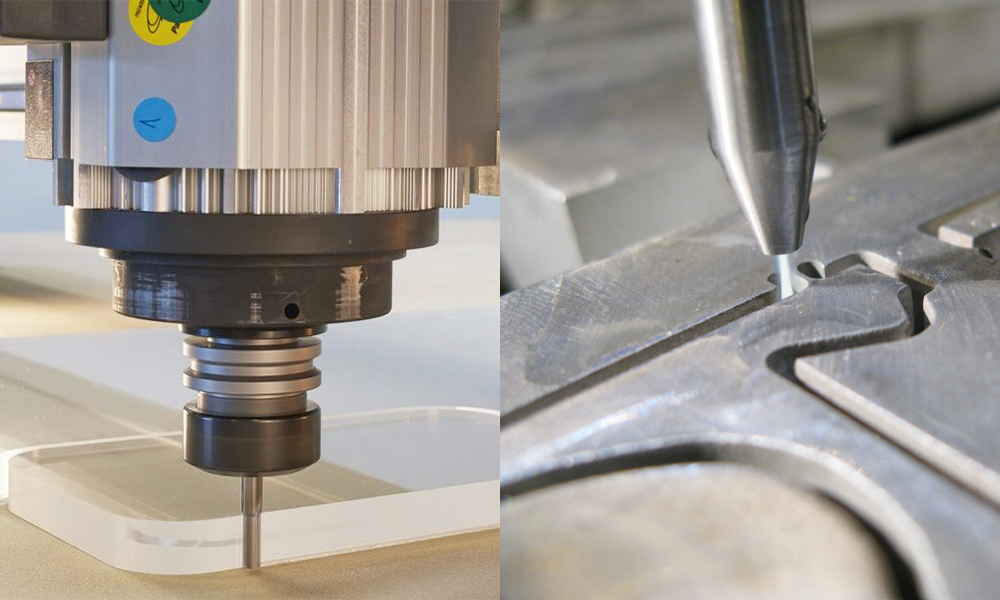

We've built and installed thousands of CNC router machines across a diverse industry portfolio to suit specific manufacturing and material cutting needs.

30+

Years OF ROUTER EXPERIENCE

40+

ROUTER accessories

100+

million router combinations

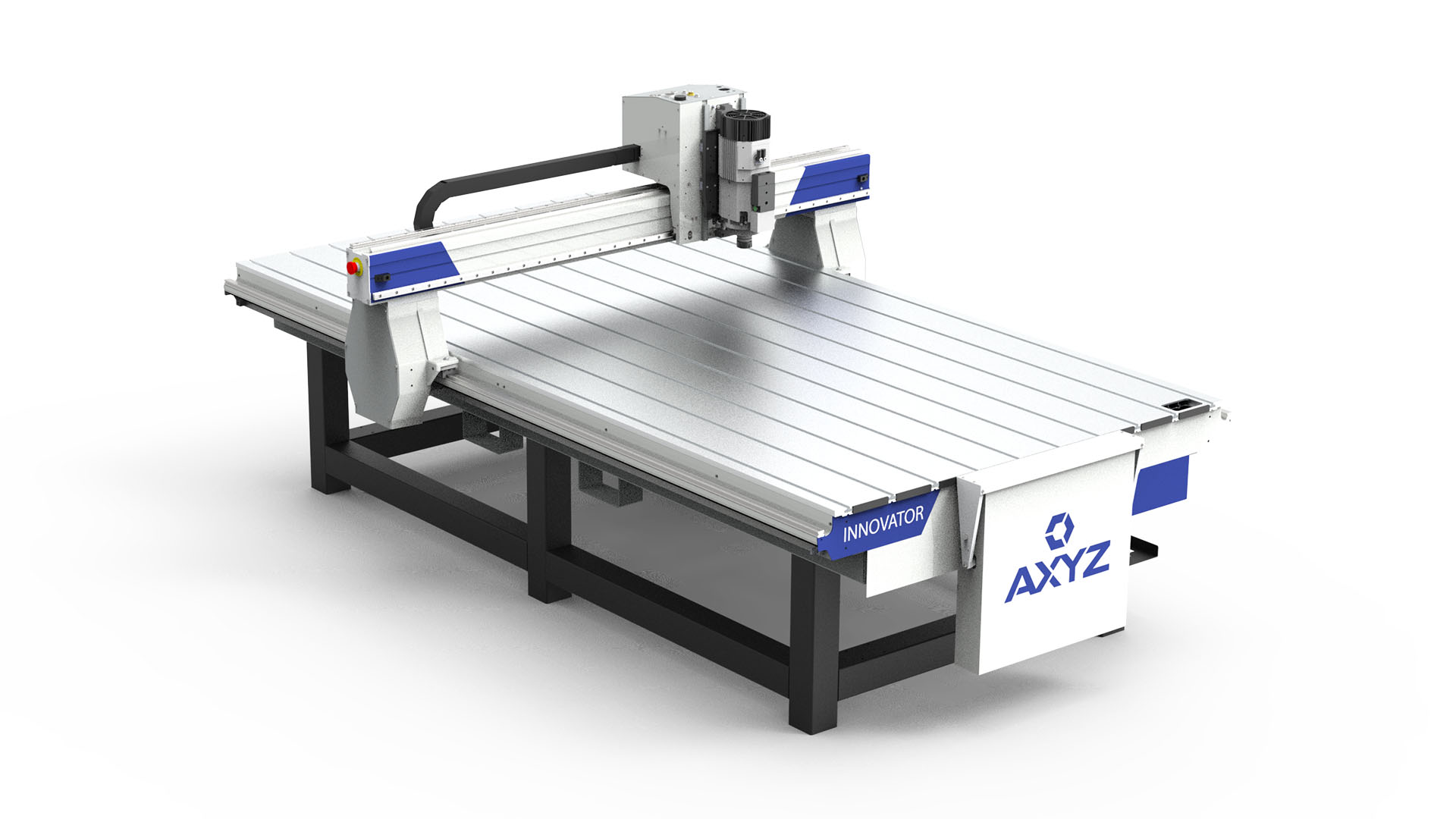

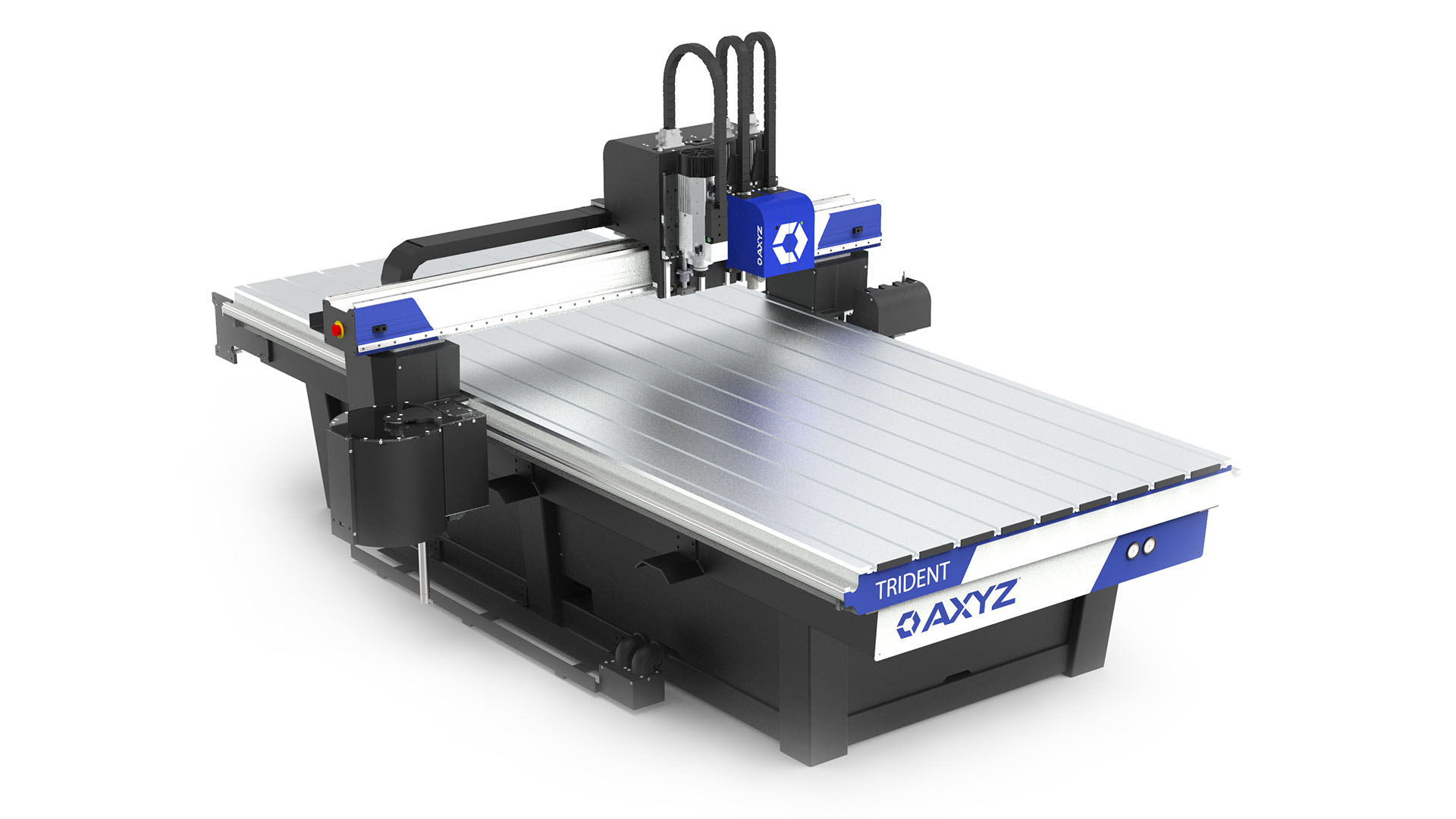

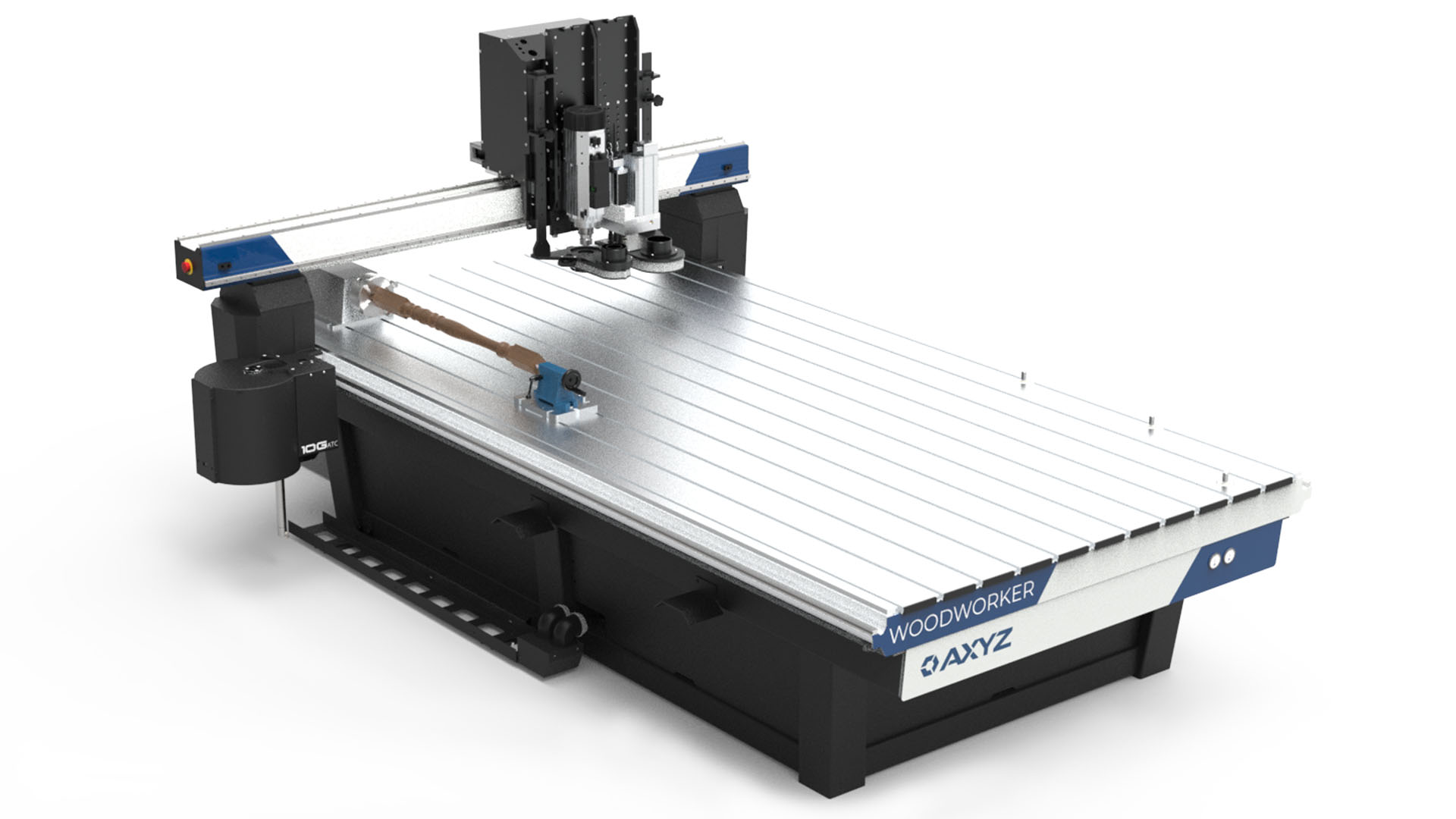

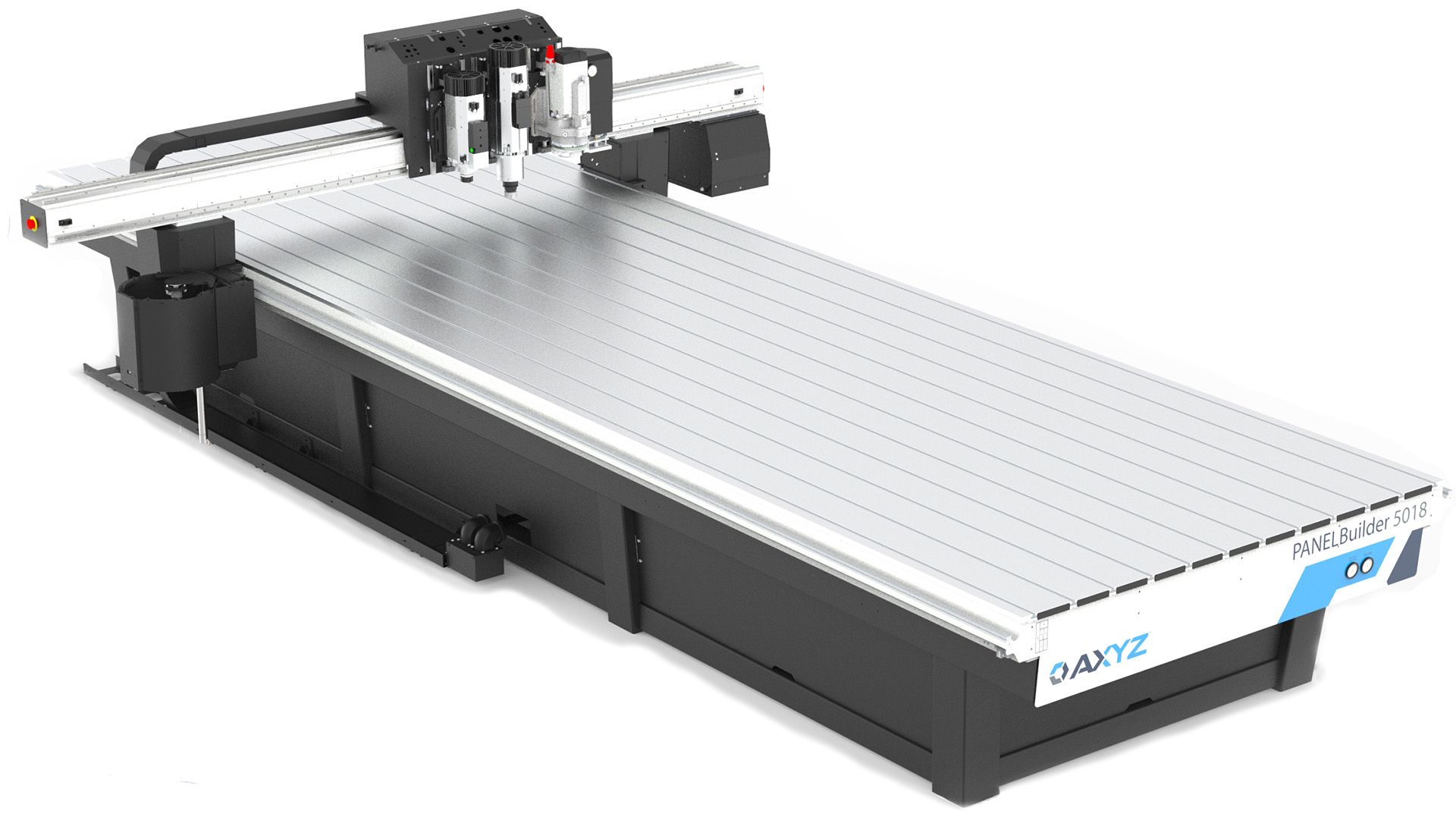

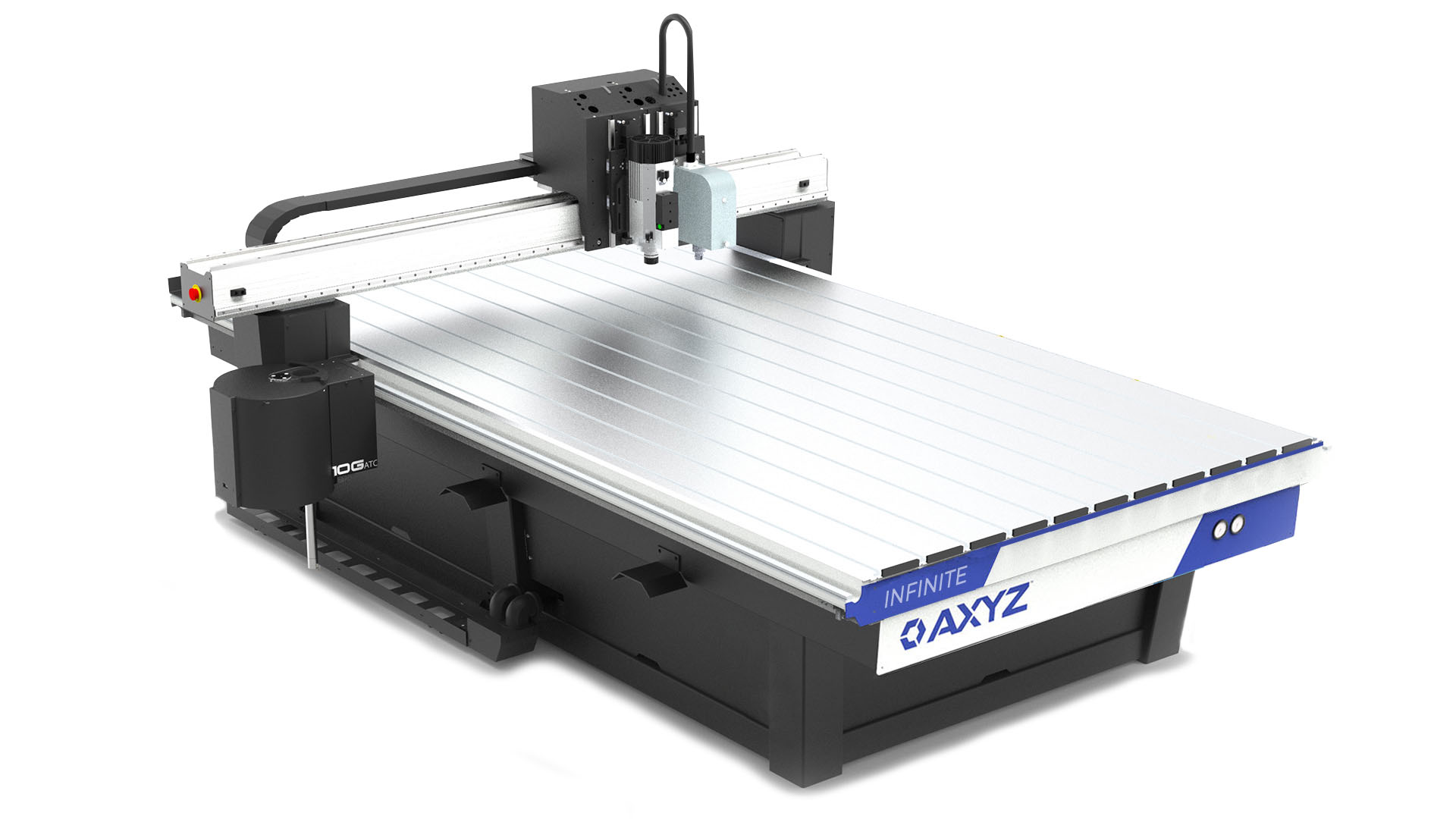

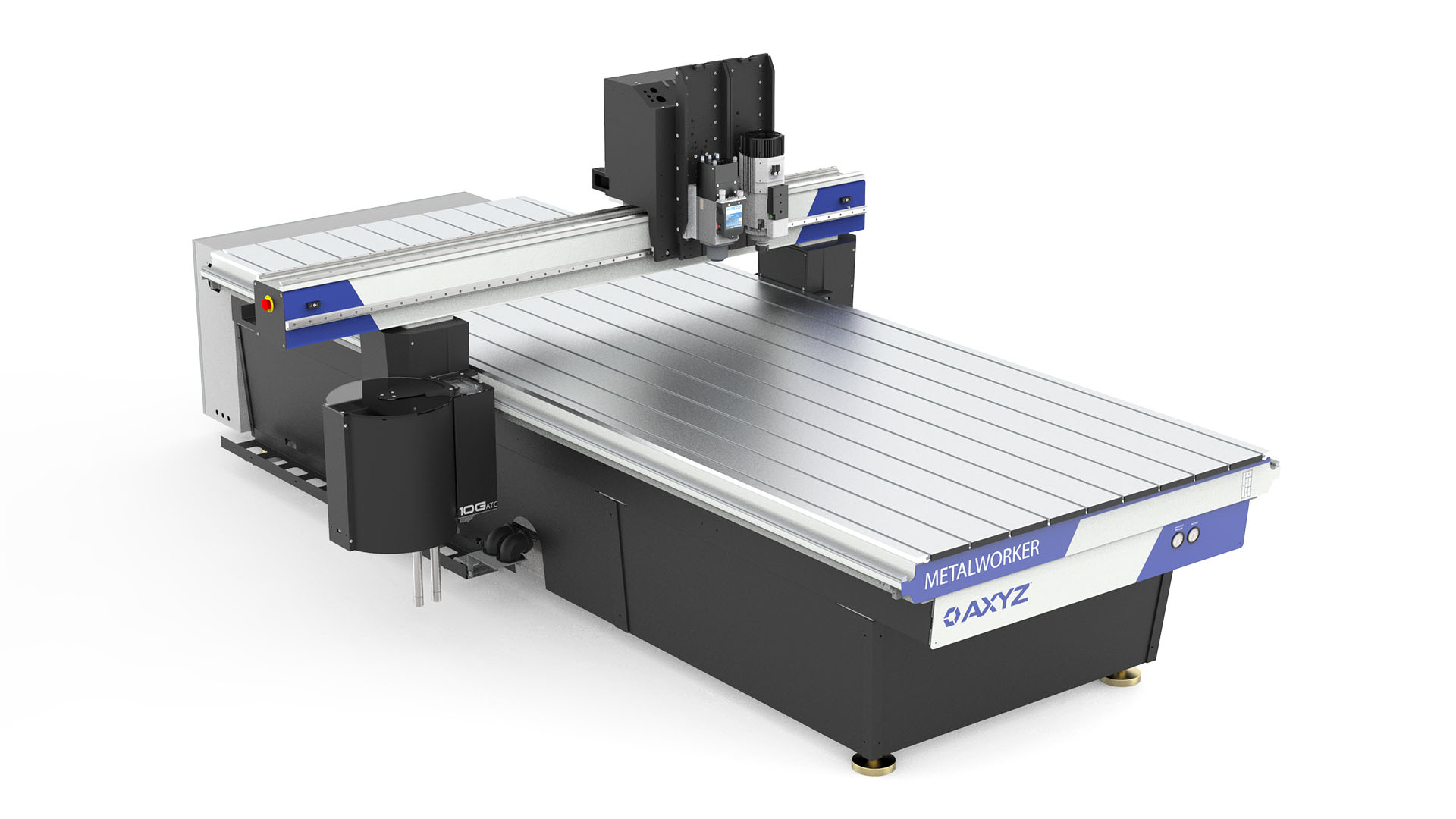

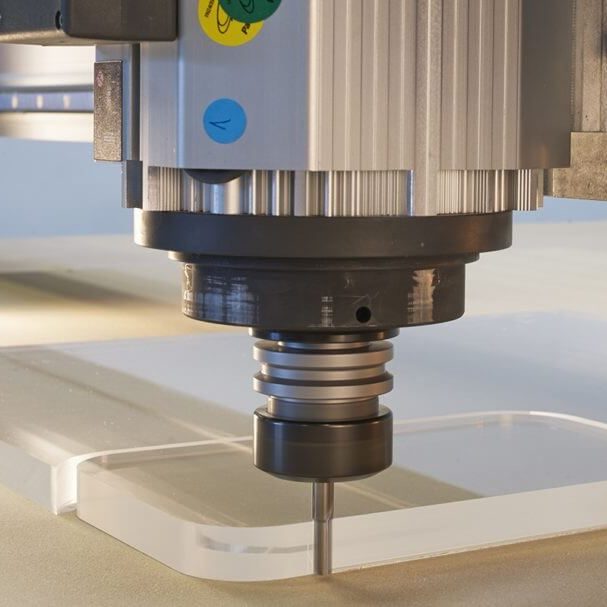

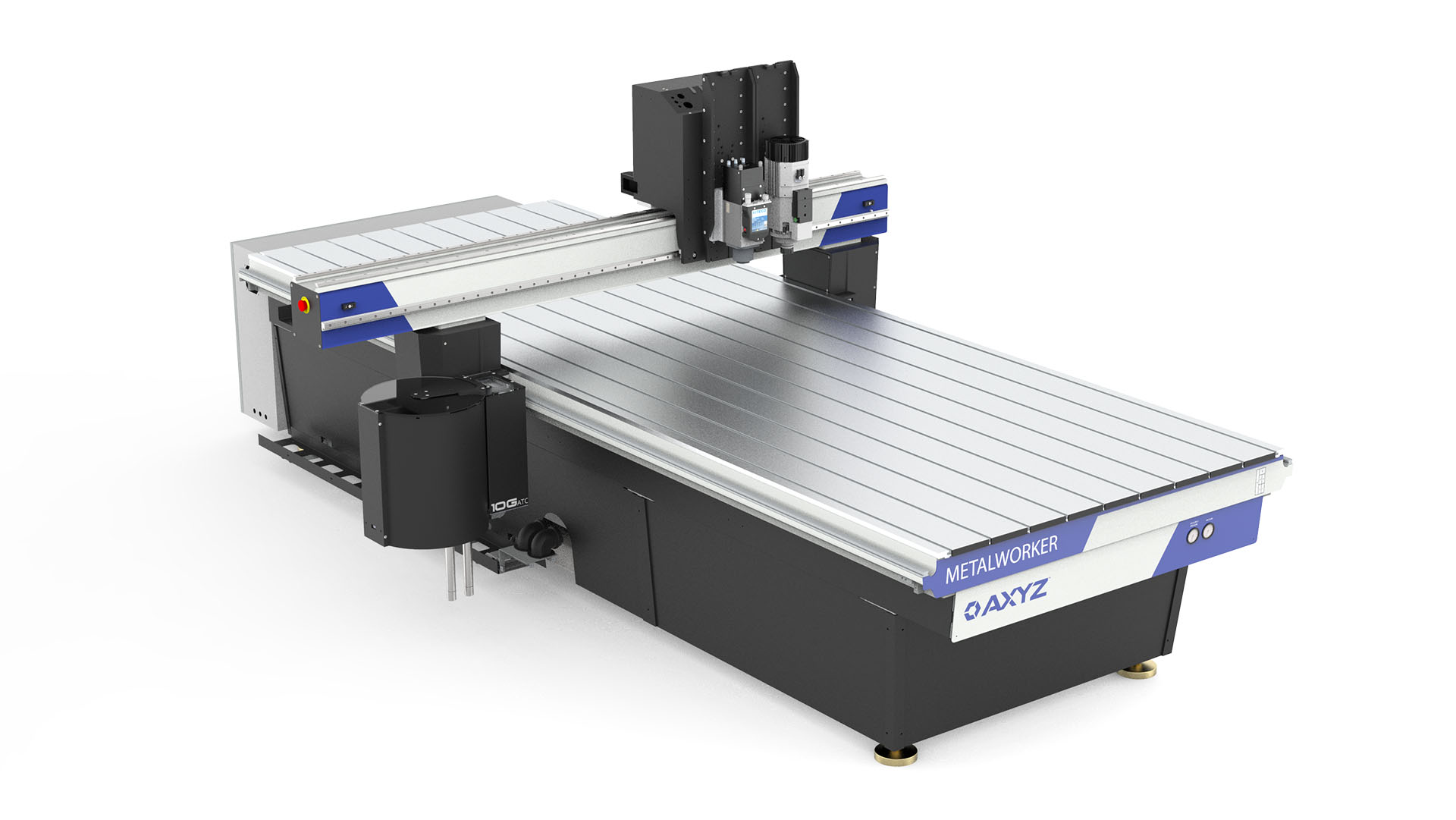

Products We Sell

AXYZ offers Tailored Router Solutions. We help you automate better with our CNC router solutions.

Our Corporate Video

This video showcases our products, services, and most importantly, our team members who work tirelessly to ensure our customers are happy and satisfied. We believe this video will give you a deeper understanding of who we are as a company and what we offer to our customers.

Our Companies

AXYZ is part of AAG Tailored Cutting Solutions. We are global leaders in modular CNC technology with a vast technical support network.

Partnerships

Get in touch

Join our team

Your perfect job is one click away. Take a look at our current opportunities here.